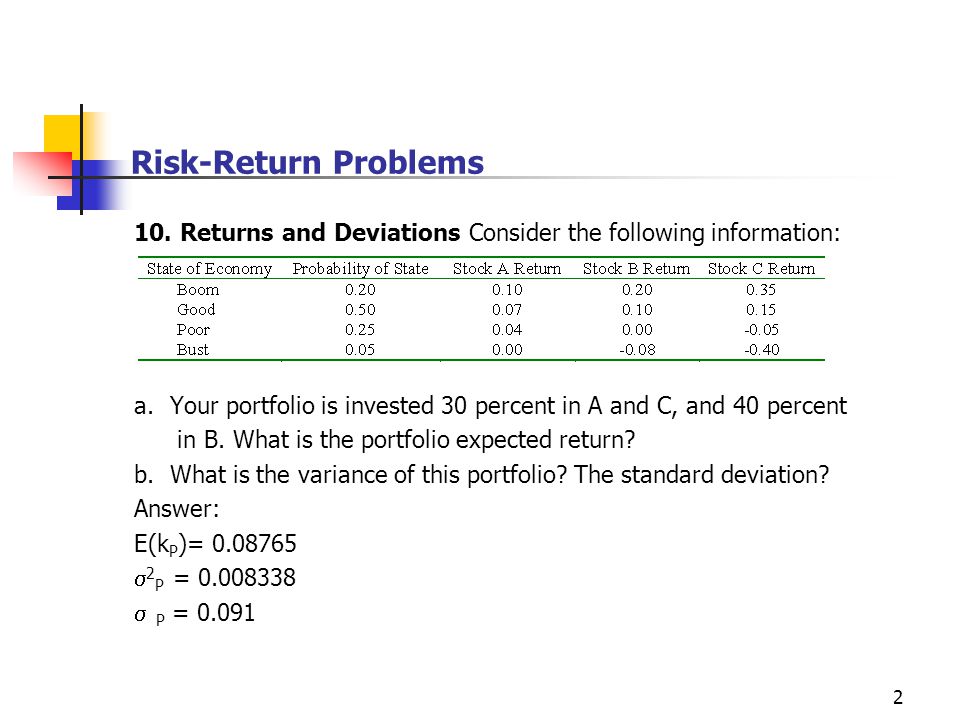

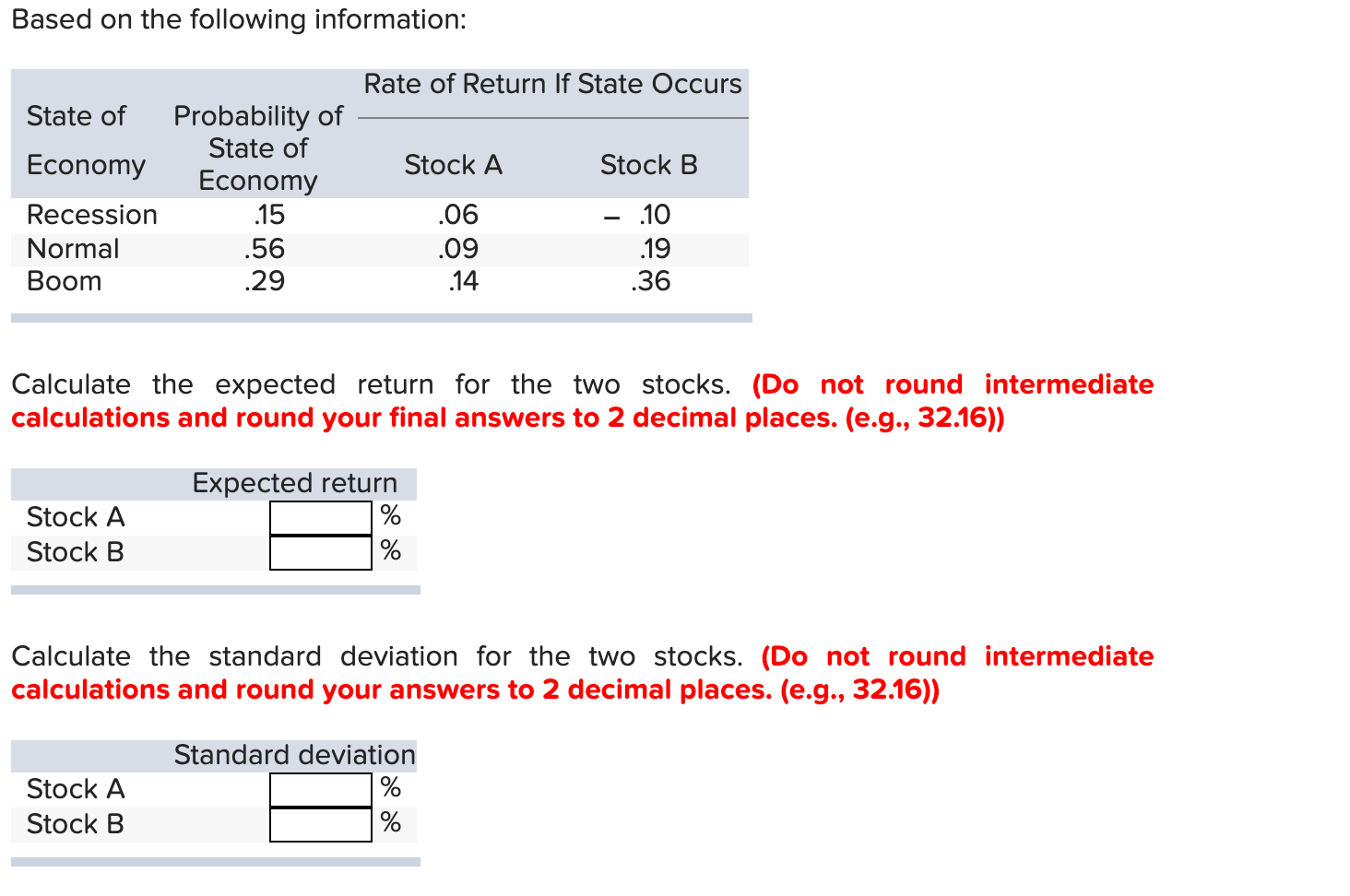

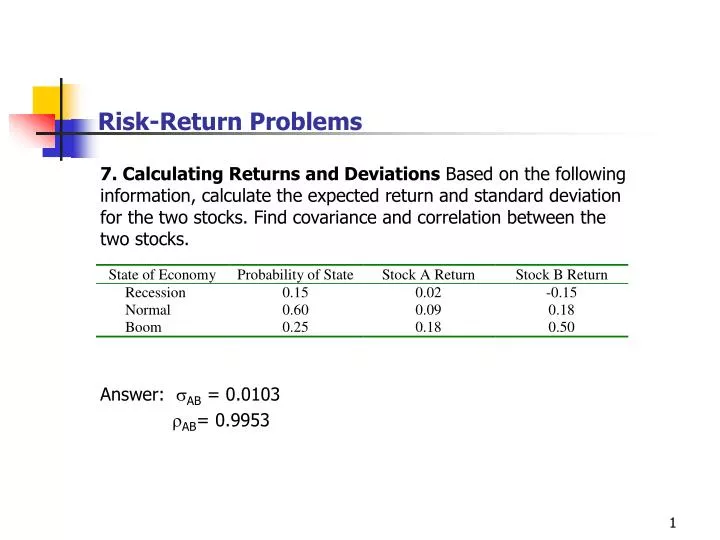

Risk-Return Problems 7. Calculating Returns and Deviations Based on the following information, calculate the expected return and standard deviation for. - ppt video online download

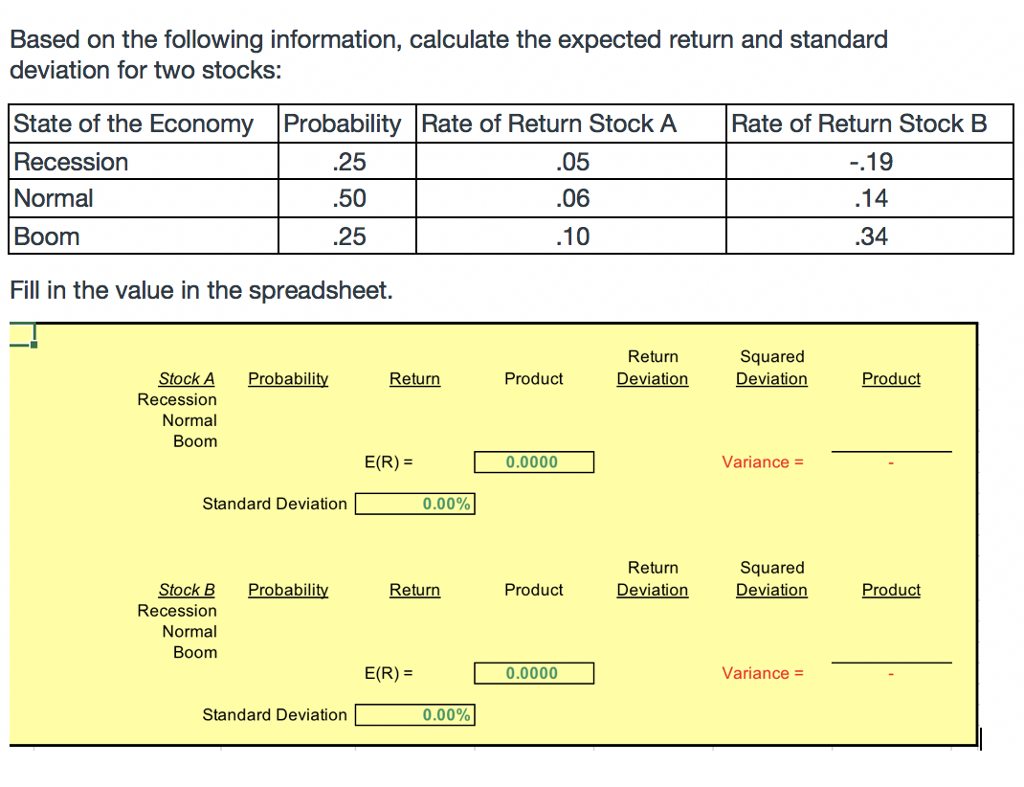

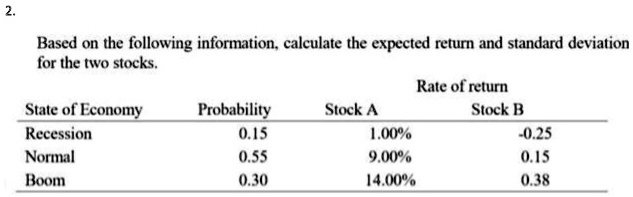

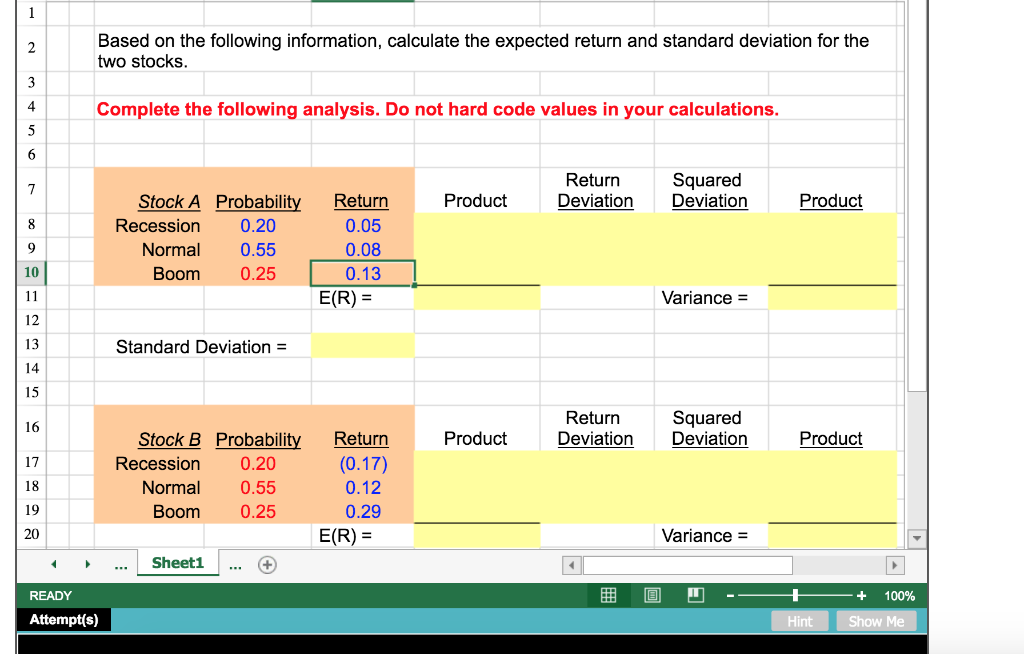

SOLVED: 2. Based on the following information, calculate the expected return and standard deviation for the two stocks. Rate of return State of Economy Probability Stock A Stock B Recession 0.15 1.00%

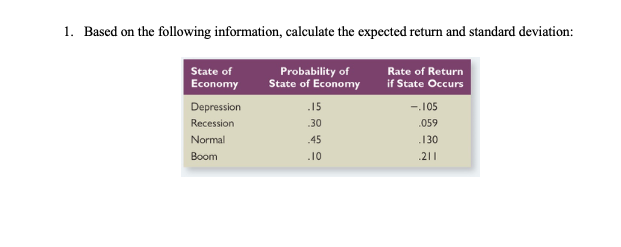

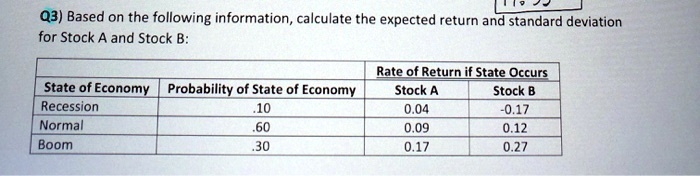

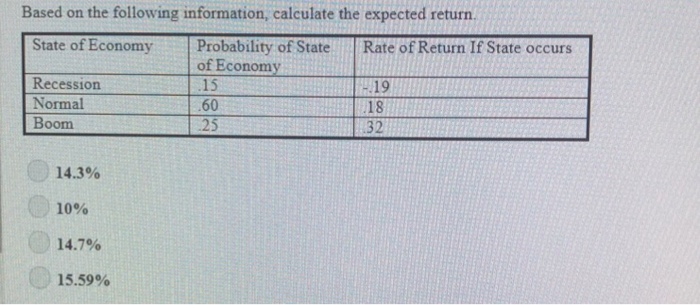

SOLVED: I. Based on the following information, calculate the expected return and standard deviation: State of Economy Probability of State of Economy Rate of Return if State Occurs Depression Recession Normal Boom .

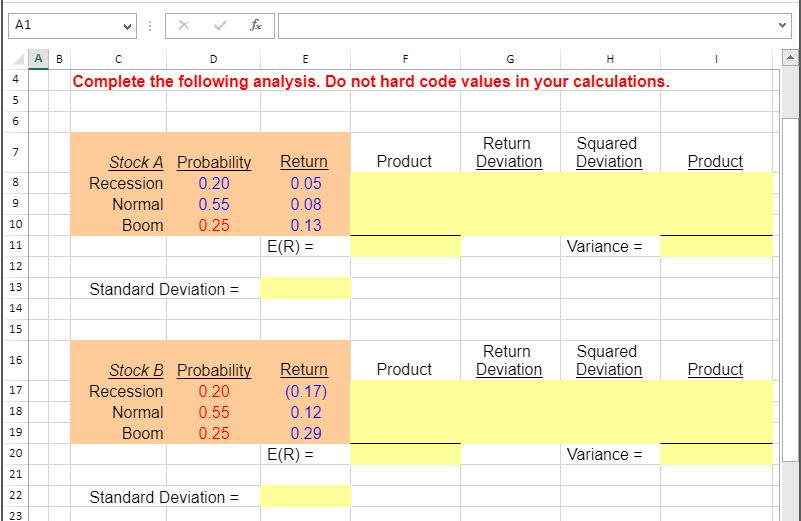

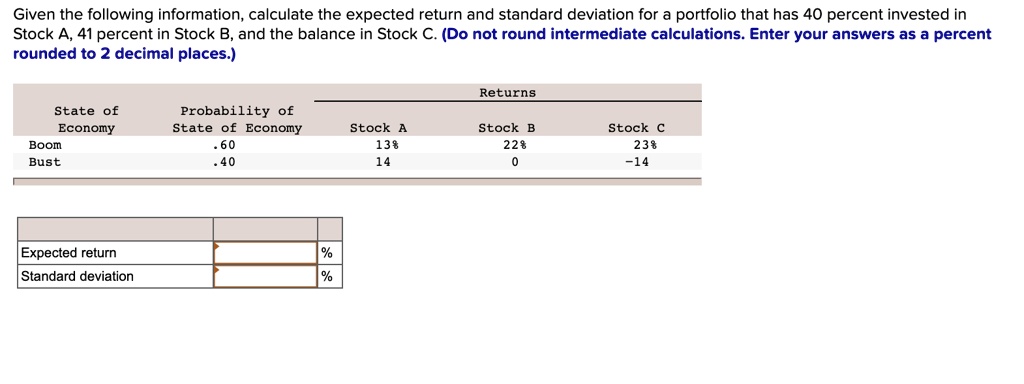

SOLVED: Given the following information,calculate the expected return and standard deviation for a portfolio that has 4o percent invested in Stock A.41 percent in Stock B,and the balance in Stock C.Do not

![Solved 6. Calculating Expected Return [L01] Based on the | Chegg.com Solved 6. Calculating Expected Return [L01] Based on the | Chegg.com](https://media.cheggcdn.com/media%2F049%2F049af385-dedd-44fb-9c10-b79a14d841f4%2FphpOzRDJH.png)

![Solved] Based on the following information, calcu | SolutionInn Solved] Based on the following information, calcu | SolutionInn](https://s3.amazonaws.com/si.question.images/images/question_images/1605/0/8/5/6855faba9f5b913f1605085684609.jpg)